|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

This Under-the-Radar Hydrogen Stock Is Surging on AI Data Center Plans. Should You Buy Shares Now?/Green%20hydrogen%20by%20Scharfsinn%20via%20Shutterstock.jpg)

Bloom Energy (BE) stock surged over 20% last week, hitting an all-time intraday high of $47.21, after CEO KR Sridhar revealed the company expects to announce additional power supply agreements for artificial intelligence (AI) data centers soon. The fuel cell technology provider has emerged as a surprising beneficiary of the AI boom, as data centers scramble to secure reliable power sources for energy-intensive AI workloads. Bloom's recent partnership with Oracle (ORCL) demonstrates the growing demand for on-site power solutions that can be deployed rapidly.

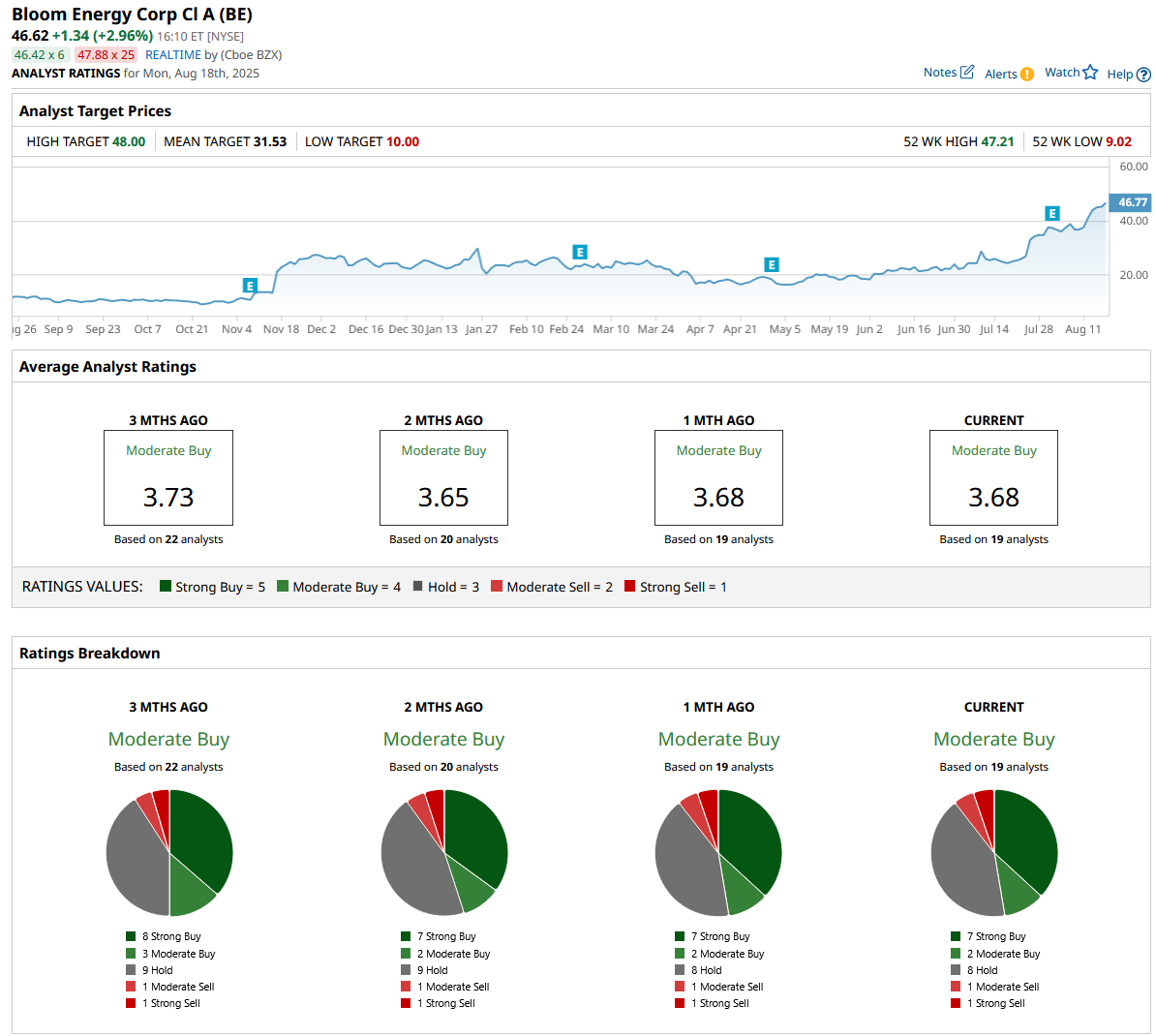

Sridhar told Bloomberg that Bloom Energy is in talks with other major data center developers, teasing that investors should expect announcements similar to the Oracle deal. Bloom currently provides more than half a gigawatt of electricity to data centers, with total capacity exceeding 1 GW, and aims to double that to 2 GW by the end of 2026. Bloom’s value proposition centers on speed and reliability, as it can deliver cost-efficient onsite power for an entire data center within 90 days. With over 400 MW already deployed to power data centers worldwide and partnerships including Equinix (EQIX) and American Electric Power (AEP), Bloom appears well-positioned to capitalize on AI infrastructure growth. How Did the Hydrogen Stock Perform in Q2 of 2025?Bloom Energy's impressive second-quarter earnings results provide concrete evidence that its AI data center strategy is translating into meaningful financial performance. The company delivered a record Q2 revenue of $401 million, up 19.5% year-over-year (TOY), while gross margins expanded to 28.2% from 21.8% in the prior year period. It reported an operating income of $28.6 million in Q2, compared to $3.2 million in the year-ago period. This was the third consecutive quarter of record profits and operating margins, showcasing the scalability of Bloom's business model as demand accelerates. Bloom's service business has now been profitable for six consecutive quarters, achieving double-digit percentage margins for the first time ever. This consistency indicates improving reliability and operational efficiency that should appeal to mission-critical data center operators. CEO KR Sridhar emphasized during the earnings call that hyperscalers collectively will spend over $500 billion in capital expenditures in 2025, with at least $50 billion needed for power capital equipment. This represents demand equivalent to more than one nuclear power plant's worth of base load capacity every month, a market opportunity that traditional grid infrastructure cannot address at "AI speed." Bloom’s manufacturing expansion plans are fully funded, requiring approximately $100 million spread across multiple quarters to reach 2-gigawatt annual capacity. Management expects this secular trend to continue well beyond 2026, positioning the expansion as just the beginning of multi-gigawatt capacity builds. With positive cash flow from operations expected and the recent refinancing of $113 million in convertible notes, Bloom appears financially positioned to capitalize on what Sridhar called "the largest market opportunity in enterprise power history." Is BE Stock Overvalued Right Now?Analysts tracking Bloom Energy forecast revenue to rise from $1.47 billion in 2024 to $2.56 billion in 2027. In this period, adjusted earnings are forecast to expand from $0.28 per share to $1.31 per share. BE stock is priced at 78.5x forward earnings, higher than its one-year average of 47.4x. If the hydrogen stock can command a 50x forward earnings multiple, which is not too steep, it should trade around $65 over the next 12 months, indicating an upside potential of over 45% from current levels. Out of the 19 analysts covering Bloom Energy stock, seven recommend “Strong Buy,” two recommend “Moderate Buy,” eight recommend “Hold,” one recommends “Moderate Sell,” and one recommends “Strong Sell.” The average Bloom Energy stock price target is $31.53, which is below the current price of $46.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|